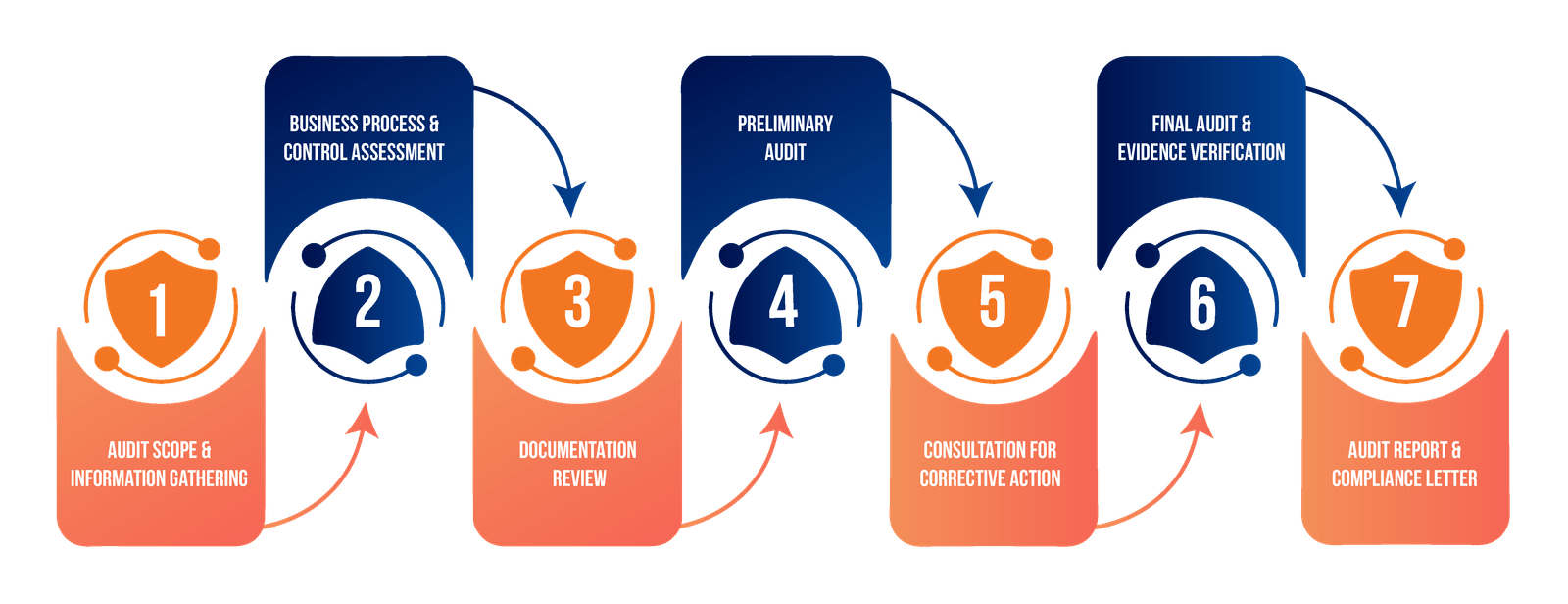

The audit process begins with the pre-audit phase, which involves defining the scope of the audit, reviewing documentation, identifying controls, planning the audit, and allocating resources. This meticulous preparation sets the foundation for a thorough and effective audit.

During the execution phase, we carry out control testing, conduct vulnerability assessments, review configurations, evaluate policies, and assess processes. This hands-on approach allows us to identify and address security weaknesses effectively.

The audit culminates in the reporting phase, where we document findings, classify risks, provide remediation recommendations, and deliver an executive summary along with a detailed technical report. This comprehensive reporting ensures that stakeholders have a clear understanding of the audit outcomes and the steps needed for improvement.