The Payment Card Industry Data Security Standard (PCI DSS) is a comprehensive set of security standards designed to enhance the protection of cardholder data for organizations that store, process, or transmit credit card information. Developed in 2004 by the Payment Card Industry Security Standards Council (PCI SSC), which includes major credit card companies like Visa, Mastercard, and American Express, PCI DSS aims to strengthen your defenses against payment card theft and unauthorized access.

At Aspirehigh Consultant, we understand that securing payment card data is crucial for your business success. As a leading PCI DSS certification consultant in India, we offer comprehensive guidance and support throughout your compliance journey.

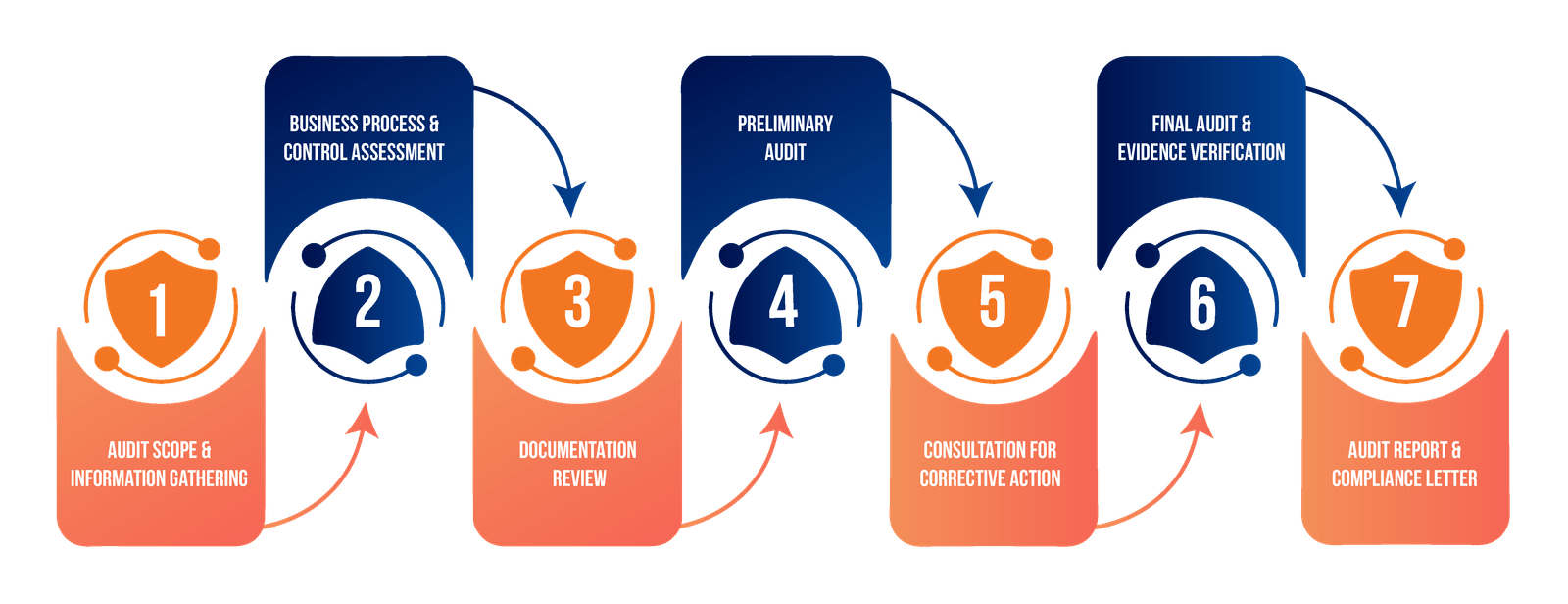

We evaluate your infrastructure through gap analysis, develop a customized compliance roadmap, and implement staff training programs while ensuring thorough documentation of all processes.

We guide you through PCI DSS requirements with technical configuration support, security control implementation, and policy development, maintaining continuous progress monitoring throughout.

Our certification support includes comprehensive audit preparation and meticulous evidence collection and organization. We manage all QSA coordination and representation, providing rapid responses to any audit queries that arise. Once certification is achieved, we develop a detailed post-audit action plan to maintain compliance standards.

We provide ongoing quarterly compliance monitoring, vulnerability management, technical support, and early preparation for annual recertification to ensure continuous compliance.

We evaluate your payment card processing environment, assess systems against PCI DSS requirements, identify compliance gaps, and develop a customized roadmap toward compliance.

We guide security controls implementation, assist with policy development, conduct staff training, and maintain comprehensive documentation aligned with PCI DSS standards.

We conduct system testing, vulnerability assessments, and mock audits while optimizing documentation and developing risk mitigation strategies before certification.

We coordinate with QSAs, manage evidence collection, provide audit support, and develop maintenance plans to ensure ongoing compliance post-certification.

PCI DSS compliance requires initial investment in security measures, staff training, and possibly infrastructure upgrades. However, this investment typically costs far less than potential losses from data breaches, which include fines, legal fees, reputation damage, and lost business. Compliance also often leads to improved operational efficiency and reduced insurance premiums.

The biggest challenges include maintaining comprehensive documentation, implementing proper network segmentation, managing third-party vendor risks, ensuring continuous security monitoring, and keeping up with evolving security threats. Many organizations also struggle with legacy systems that may not support current security requirements and the need for ongoing staff training.

The PCI Security Standards Council typically releases major updates every 2-3 years, with the most recent version being PCI DSS 4.0 released in March 2022. Minor updates and clarifications may be issued more frequently. Organizations usually get 12-24 months to transition to new versions after they’re released.

Penalties can include monthly fines ranging from $5,000 to $100,000, increased transaction fees, and potential termination of the ability to process card payments. In case of a data breach, non-compliant organizations face even steeper fines, mandatory forensic audits, damage to brand reputation, and possible legal action from affected customers.

Network segmentation reduces the scope of PCI DSS compliance by isolating the cardholder data environment (CDE) from other business networks. This means fewer systems and components need to meet PCI DSS requirements, which reduces complexity, cost, and risk. It also provides an additional security layer by limiting potential breach impact to segmented areas only.