IRDAI regulates and ensures cybersecurity and data confidentiality in India’s insurance industry.

Insurance companies undergo mandatory IRDAI ISNP Audits to ensure cybersecurity compliance and prevent breaches.

We conduct thorough evaluations of your current practices against IRDAI regulations, identifying gaps and areas for improvement.

Our experts assist in creating and updating policies and procedures that align with IRDAI guidelines, including information and cyber security policies.

We help implement robust cybersecurity measures as per IRDAI recommendations, including vulnerability assessments and penetration testing (VAPT).

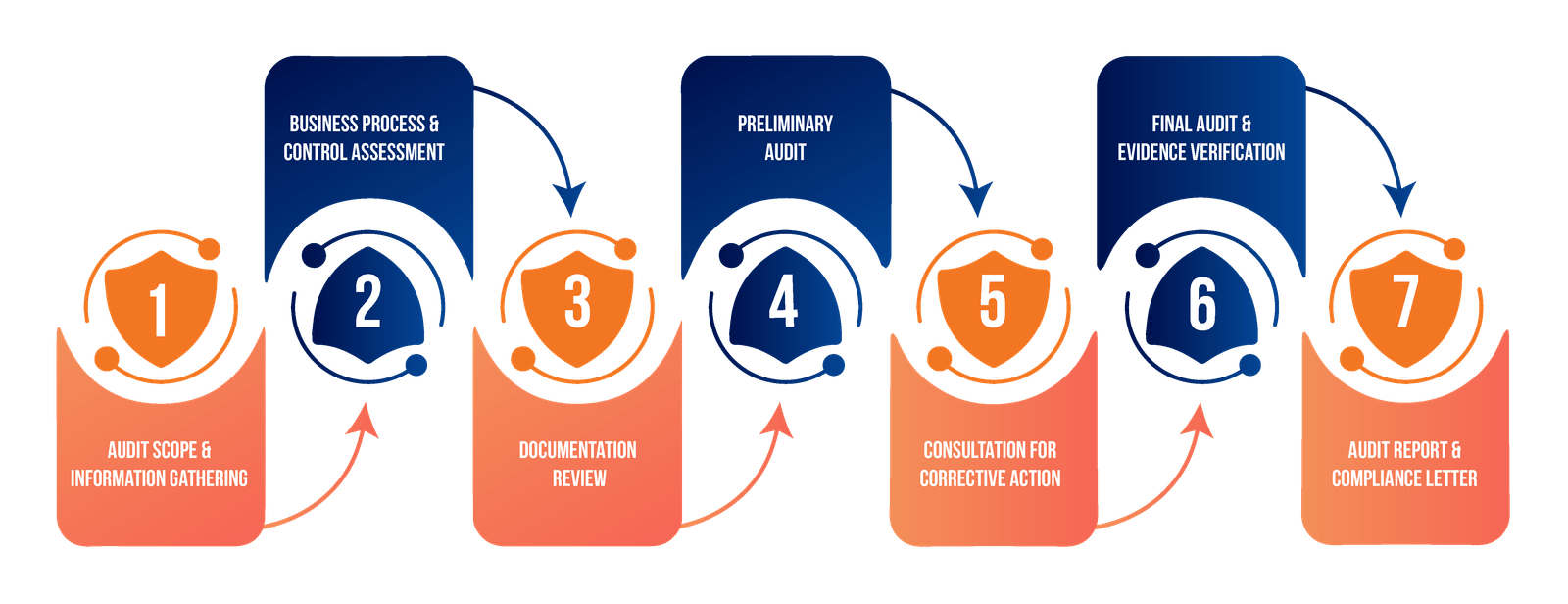

We provide assistance in preparing for and conducting annual information and cyber security audits, as mandated by IRDAI.

We offer guidance on appointing or designating a qualified Chief Information Security Officer (CISO) and support in formulating necessary security policies.

We assist in preparing and submitting required reports to IRDAI, ensuring timely and accurate compliance.

We conduct training sessions for your staff to ensure they understand and adhere to IRDAI compliance requirements.

We provide ongoing support to keep your organisation updated with the latest IRDAI regulations and assist in implementing necessary changes.

Aspire High Consultants is a boutique IT Risk Solution consulting firm currently engaged in the business of providing risk management solutions in specific domains

Address