RBI issues guidelines for banks and NBFCs to mitigate cyber risks and operational weaknesses.

RBI issues cyber security guidelines for NBFCs to protect data.

Explore RBI Cyber Security Framework and Aspire High Consultants’ support.

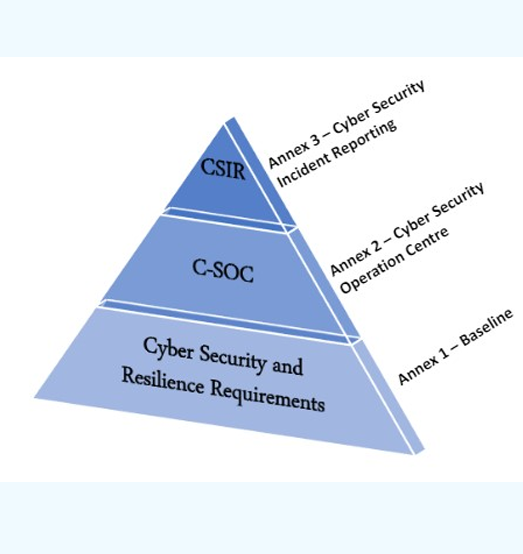

RBI’s Cybersecurity Framework focuses on modern financial security needs.

Our team comprises seasoned cybersecurity professionals with in-depth knowledge of RBI guidelines.

We understand that every organisation is unique, and we customise our services to meet your specific needs.

We utilise state-of-the-art tools and methodologies to ensure comprehensive compliance.

Our relationship doesn't end with initial compliance; we provide continuous support to maintain your compliance status.

Based in Kolkata, we understand the nuances of the Indian financial sector and regulatory environment.

We have successfully guided numerous organisations through the compliance process, earning their trust and loyalty.

We don't just tick boxes; we work to integrate compliance into your overall business strategy for long-term success.

All Scheduled Commercial Banks, urban cooperative banks, payment banks, credit card-issuing NBFCs, and other financial institutions regulated by the RBI.

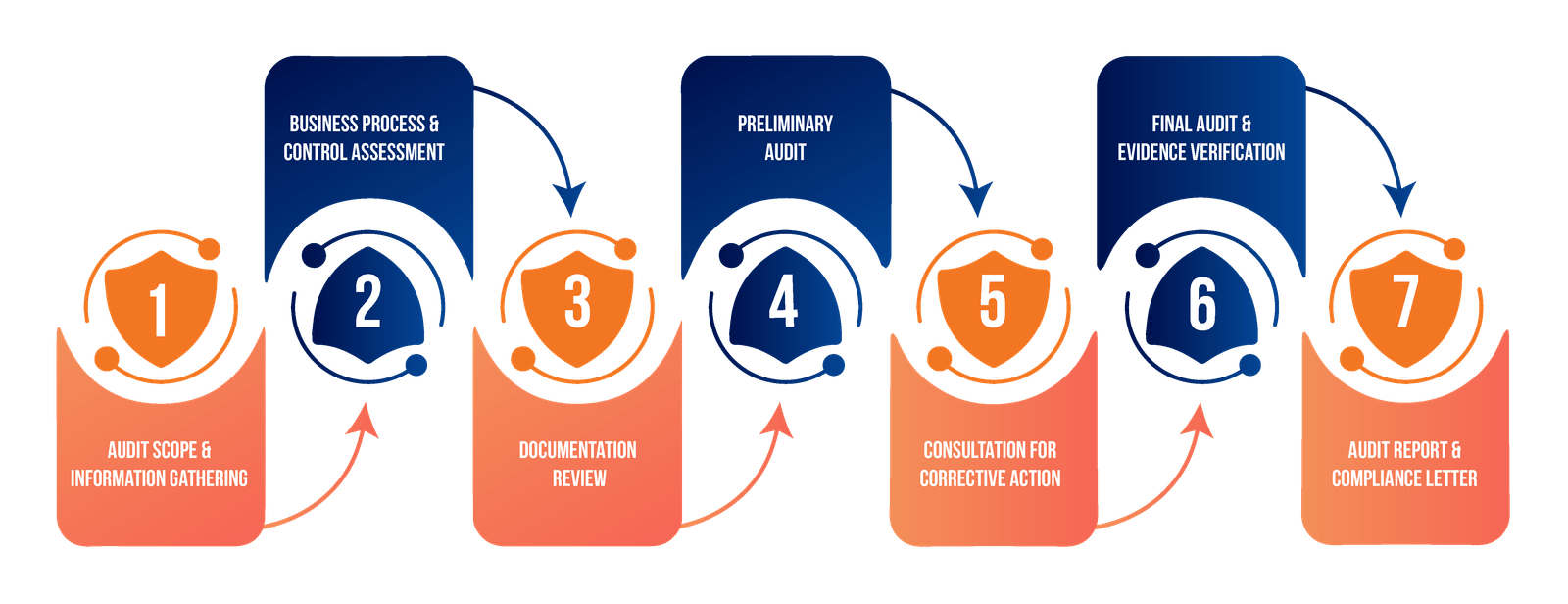

The RBI recommends annual comprehensive audits, but continuous monitoring and periodic assessments are crucial.

Penalties can include fines, restrictions on business activities, and in severe cases, revocation of banking licences.

The timeline varies depending on your current security posture and the size of your organisation. Typically, it can take 3-6 months for initial compliance.

While possible, many organisations find it beneficial to partner with experts like Aspirehigh Consultant to ensure comprehensive compliance and leverage specialised knowledge.