SEBI mandates cybersecurity audits for market intermediaries to ensure integrity.

SEBI’s cybersecurity framework mandates robust protection across financial entities.

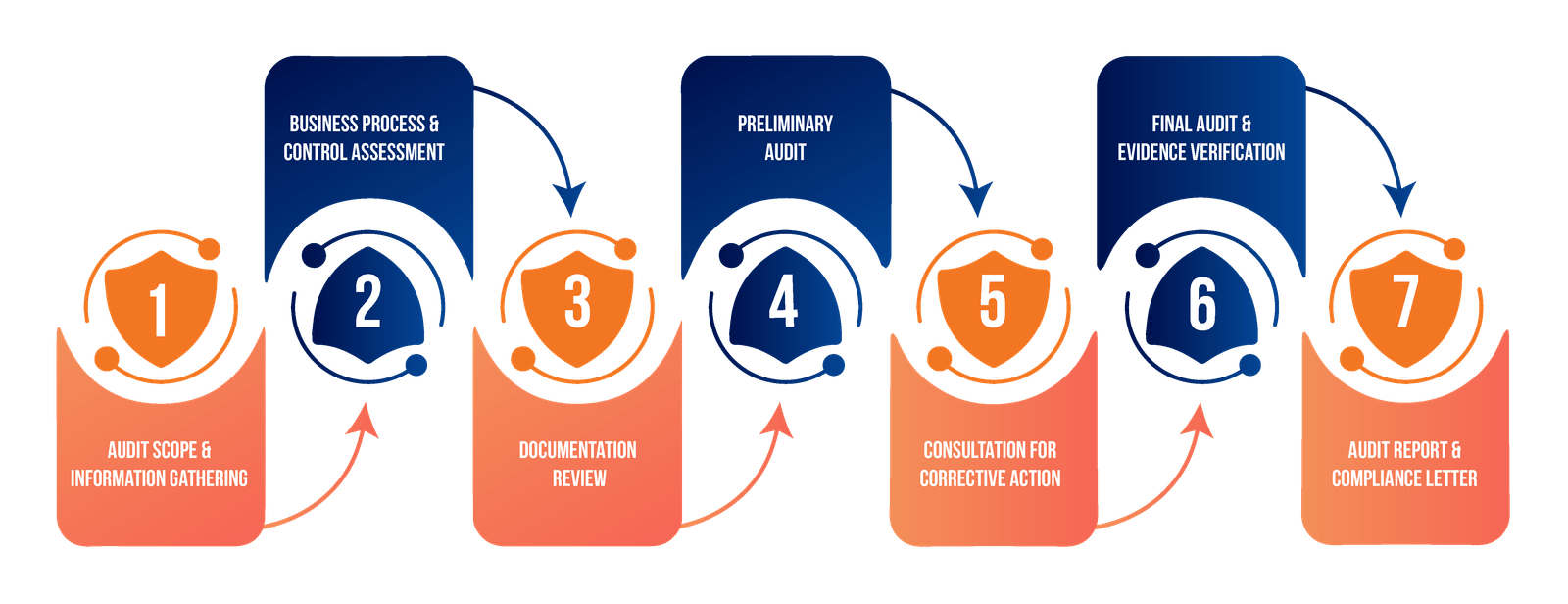

Our team begins by developing a deep understanding of your business operations and unique challenges. We carefully identify all applicable regulations relevant to your organization's activities. Through detailed analysis, we determine the appropriate scope of the audit to ensure comprehensive coverage.

We conduct thorough document examinations to verify regulatory adherence across all required areas. Our process evaluation ensures all operational procedures align with SEBI guidelines. Through control testing and gap analysis, we identify areas requiring attention or improvement.

Our expertise includes identifying specific compliance risks that could impact your organization. We evaluate the effectiveness of existing control measures and their ability to address potential risks. Our assessment includes determining impact levels of various compliance factors on your business operations.

We provide detailed audit findings that clearly outline your compliance status. Our reports include comprehensive identification of compliance gaps requiring attention. We offer actionable recommendations for addressing identified issues. Clear implementation guidance is provided to help you achieve and maintain compliance.

We provide dedicated implementation assistance to help you address audit findings effectively. Our team conducts regular progress monitoring to ensure successful implementation of recommendations. We offer continuous guidance to help maintain compliance standards over time.